Money Management in Trading

Money management in Trading is the make-or-break skill set that will impact a trader’s longevity the most. Money management entails managing risk and leverage. The leverage part is where the danger is the greatest. Even if a trader has an 80% win rate, poor money management on the 20% can wipe out the account.

Example of Money Management in Trading for Beginners

Traders have the capability of doing all types of trading such as Swing Trading, Intraday Trading, Positional Trading, etc. Traders also have a good strategy or unique system for taking a trade regularly. But he has poor money management skills where he is lacking too much and grabbing a loss at the end of the day.

Reasons for Holding a Loss are as follows:-

- Poor Money Management.

- Fear and Greed while Trading.

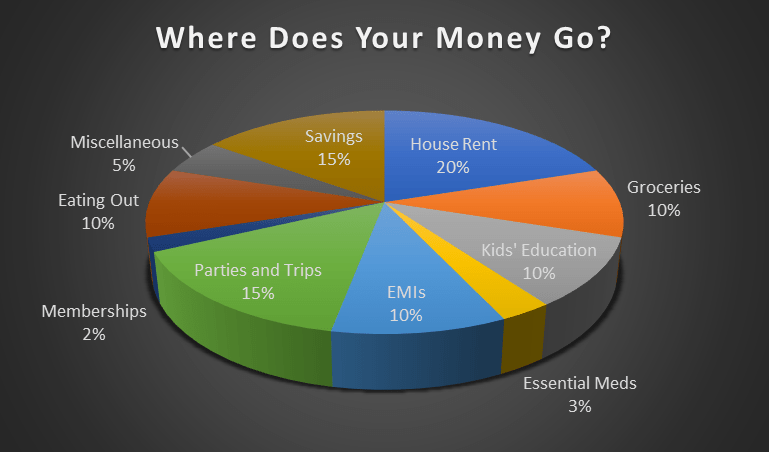

Money Management is the only way to minimize the losses and gain profit with a good risk-reward ratio. Every trader knows that a 2 % loss is more than enough in a 1 lakh capital in Intraday trading.

The above line conveys that this concept is known by every trader but they won’t be able to follow this scenario due to emotional trading or as well as fear and greed.

Let us say that a trader has 5 lakh in his Demat account and he comes with a fresh mind after he goes through the concept of Money management.

Now the trader is thinking that he is capable of doing money management quite easily as he understands what money management is and how much he can risk his capital, which is only 2% of his capital.

So now he starts to find opportunities to grab a trade. The first time got a loss of 5k in the first trade then again got a loss of 5k in the second trade total loss is equal to 10k.

Now the trader is thinking that the market is going in my direction. If I would maximize the stop loss that is up to 10k then stop-loss won’t be able to trigger yet.

So let me take another trade as the market is going in my direction now I will put a 10k as stop loss so that it won’t be able to trigger and at the end of the day I would be covering my losses and becoming profitable too.

Is it going to happen at the end of the day? Are you going to become profitable or not is the biggest fear you will have until and unless that trade closes? There is a possibility of going to lose this trade too.

It doesn’t mean that if you have increased the stop loss it won’t trigger. It will take some more time as compared to the previous trade but it will definitely hit the stop loss and now you will regret it.

So try to avoid these kinds of mistakes in trading if losses happen. Never try to fight with the market. The market doesn’t care about anyone’s money literally whether he is a retail trader or an operator or an investor. The market cares about only those traders who follow proper trading plans with an effective money management system.

Mastering of Money Management in trading

Tip 1: Have a Pocket Size Stop Loss

- Traders need to have that much stop loss on an Intraday which does not affect his mental condition.

- Also, traders need to enter a market only if they have free money in their pocket because if they lose that money then it won’t affect their living expenses.

- If traders enter a market then he has made himself ready that the market is going to take stop loss regularly. I have made up my mindset that they are going to take at least 10 losses from me in the initial period.

- It will reduce your fear of losing money and it will increase your profitability if you are going to follow the proper risk-reward ratio and money management.

Tip 2: Find Trades with Solid Risk/Reward Ratio

- Traders don’t need to hurry while taking the trades. They need to keep an eagle eye on the charts for entering into good trades.

- They need to find the best trade with a proper risk-reward ratio so that they don’t fear losing the trade.

- Typically, this is the risk/reward ratio where the potential loss is compared to the potential profit.

- The conventional thinking is to always have at least a 1:2 risk-reward ratio (ideally, closer to 1:3 or higher).

Tip 3: Don’t Average Down

- Never try to average down your positions if you do so you are not following a proper money management strategy.

- Averaging down the losing trade means Ax on your foot which means that you are going to wipe out your account sooner.

- Averaging down from a position of weakness without a plan is a surefire way to blow out an account. In these situations, a trader averages down out of desperation and hope.

Tip 4: Take Breaks

- Trading on a regular interval is not important as it affects mindset so try to take breaks for some time and give your eye and mind some relaxation time to avoid stressful situations.

- You may also find that taking breaks from trading for longer periods can help give you the “refresh” you need.

- Taking breaks, especially after a big loss or win, can help you clear your mind and come back to trading at your best.

Tip 5: Avoid Higher Risk Trades

- Traders need to avoid higher risk-reward trades to sustain themselves in the stock market.

- Traders don’t need to hurry while taking the trades. They need to keep an eagle eye on the charts for entering into good trades.

- The market has the uncanny ability to win during high-risk trades.

- This is because the market understands that these trades are based on emotions and desperation.

- It’s human nature to fight back and go heavier when taking losses, not the other way around.

- They need to find the best trade with a proper risk-reward ratio so that they don’t fear losing the trade.

- It’s human nature to fight back and go heavier when taking losses, not the other way around.

- Typically, this is the risk/reward ratio where the potential loss is compared to the potential profit.

- The conventional thinking is to always have at least a 1:2 risk-reward ratio rather than thinking of a 2:1 risk-reward ratio.

- It will be a worst-case scenario if you are trying to grab a higher risk-reward ratio because at the end of your trading career.

Tip 6: Stick to Your Niche

- Stick to your niche means there are different types of traders such as Scalper, Day Trader, Positional Trader, Swing Trader, Price Action Trader.

- So stick to what kind of trader you are first of all master yourself in one trading style and stick to it for a longer period.

- Don’t showcase your extraordinary talent in the market while mixing up with different types of trading styles.

- If you are doing so you are solely responsible for your loss.

- Try to stick with your niche. It will help to shape your career ahead.

Tip 7: Avoid Vengeance Trading

- Avoid vengeance trading as if you are a new trader try to don’t fight with the market otherwise, your account will blow up.

- The term vengeance means to enact revenge to ‘even’ or balance things back to normal. It’s an inherent flaw that the market hopes to exploit.

- Losing money through revenge trading is going to bring you problems when it comes to your bottom line, but it also causes other, lingering issues.

- You’re trading according to emotions rather than logic and strategy. This can never work and will see you suffering even more losses as time goes on.

If you like this post kindly leave a comment in the comment section so that we can know what your thought about these candlestick patterns. For more trading ideas do follow us on