Do you know the 5 best Candlestick Patterns For Day Trading are very easy to find in the live market? to find these patterns you need to require a lot of patience. if you are an aggressive trader, you won’t be able to wait to form those patterns and jump into the trade quickly, which results in an aggressive trader.

To master these candlestick patterns for day trading you need to take at least 100 trades on one candlestick pattern to check the accuracy of the setup.

No setup will give a 100 percent result on any trade, probability is a part of trading if your setup is correct 6 times out of 10 times then your setup is doing a great job. Now you have to focus on your risk-reward ratio, at least your risk-reward ratio in these candlestick patterns for day trading should be a minimum of 1:2 ratio.

How to use candlestick patterns for day trading?

The candlesticks give you 4 different pieces of information, the first being open which means the opening price of the day in the green candle if you look the open is plotted at the bottom and the red candle if you see the opening is plotted on the top the close that is the closing price of the candle.

Each candle gives certain information about the market. Traders who are experienced and expertise in candlestick can actually predict the future and make a lot of profits based on that.

To know more about basics of candlestick patterns for day trading you can have a look on this post Candlestick Trading for Beginners.

5 Best Candlestick Patterns For Day Trading

Candlestick Patterns for day trading are as follows :

- Hammer

- Dragonfly Doji

- Shooting star

- Gravestone Doji

- Long-legged Doji

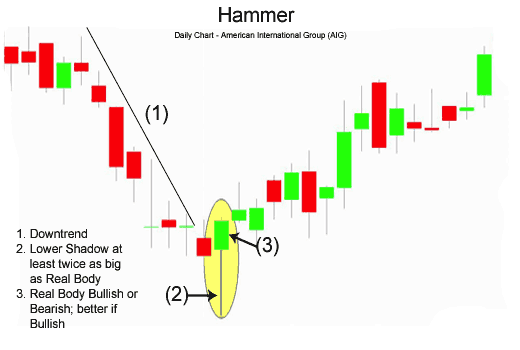

Hammer

Hammer candlestick patterns for day trading is basically a bullish reversal candlestick pattern. These patterns usually consist of a long leg and small body which means that it is a sign of reversal buyers are active and buying pressure can be seen from the formation of hammer candle.

This pattern gives you a good risk-reward ratio as compared to another setup. This setup is very easy and simple to use just you need to keep patience and let your setup form and then you can make your positions.

Dragonfly Doji

Dragonfly Doji candlestick pattern for day trading is similar to hammer candlestick which is a bullish reversal candlestick pattern. These patterns usually consist of a long leg and negligible body as shown in the highlighted figure. It means that it is a sign of reversal of a trend. Buyers are accumulating in these areas and buying pressure can be seen from the formation of the dragonfly doji candle.

You can use 5 minute or 15-minute timeframe to take a trade on this pattern. Just follow the one-time frame continuously to get a 70 percent accuracy.

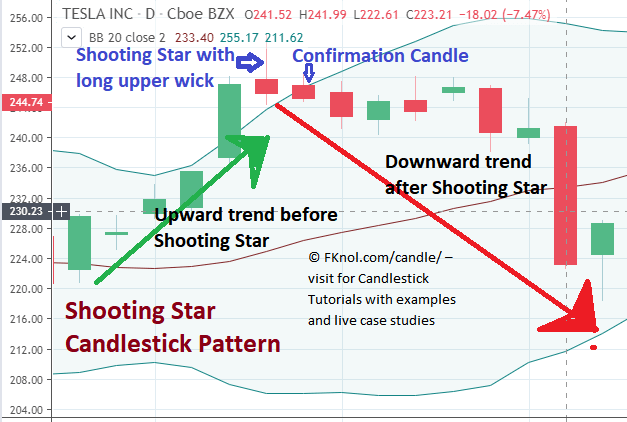

Shooting Star

Shooting Star candlestick patterns for day trading is basically a bearish reversal candlestick pattern in the Share Market. These patterns usually consist of a long leg and small body which means that it is a sign of reversal sellers is active in these areas and selling pressure can be seen from the formation of shooting star candle.

This pattern gives you a good risk-reward ratio as compared to another setup. This setup is very easy and simple to use just you need to keep patience and let your setup form and then you can make your positions.

To read more: How to Trade Shooting Star Candlestick Patterns | What is the Benefit of Shooting Star?

Gravestone Doji

Gravestone Doji candlestick patterns for day trading are similar to shooting star candlestick which is a bearish reversal candlestick pattern. These patterns usually consist of a long leg and negligible body as shown in the highlighted figure. It means that it is a sign of reversal of a trend. Sellers are accumulating in these areas and selling pressure can be seen from the formation of gravestone doji candles.

A gravestone pattern can be used as a sign to take profits on a bullish position or enter a bearish trade. The opposite of a gravestone doji is a dragonfly doji.

You can use 5 minute or 15-minute timeframe to take a position on this pattern, just keep the things simple and follow the one-time frame continuously to get a 70 percent accuracy on these patterns.

Long-legged Doji

The long-legged doji suggests that the forces of supply and demand are nearing equilibrium and that a trend reversal may occur. This is because equilibrium or indecision means that the price is no longer pushing in the direction it once was.

Long-legged doji candlesticks patterns for day trading are a member of the doji family. They are an indecision candlestick that has a small real body, long lower shadow, and a smaller upper wick. They can be found in both up trends, down trends and are bullish or bearish coloring on stock charts.

Conclusion

Candlestick patterns for day trading are usually the best trading patterns to take the trade. This setup is very easy and simple to use just you need to keep patience and let your setup form and then you can enter your positions. Stoploss should be the low of the candles and the target would be as per your risk-reward ratio. One should follow the Risk Management, Money Management, and Fear and Greed concept of the market to avoid big losses.

if you like this post kindly leave a comment in the comment section so that we can know what your thought about these candlestick patterns. For more trading ideas do follow us on

How are candlestick patterns used in day trading?

The candlesticks give you 4 different pieces of information, the first being open which means the opening price of the day in the green candle if you look the open is plotted at the bottom and the red candle if you see the opening is plotted on the top the close that is the closing price of the candle.

Each candlestick patterns gives certain information about the market. Traders who are experienced and expertise in candlestick can actually predict the future and make a lot of profits based on that.

What patterns should I look for in day trading?

Candlestick Patterns for day trading are as follows :

Hammer

Dragonfly Doji

Shooting star

Gravestone Doji

Long-legged Doji

Which candlestick pattern is most reliable for intraday?

These 5 candlestick patterns are more reliable for intra-day trading. You can use these patterns in different time frames. Mostly you can use these patterns in 5 minute and 15 minute time frames on intraday trading are as follows:

Hammer.

Dragonfly Doji.

Shooting star.

Gravestone Doji.

Long-legged Doji.

What is the best bearish candlestick pattern?

Bearish candlestick patterns are as follows:

1. Bearish Engulfing.

2. Hanging Man.

3. Gravestone Doji.

4. Shooting Star.

5. Evening Star.

What is the best bullish candlestick pattern?

Bullish candle stick patterns are as follows:

1. Bullish Engulfing.

2. Inverted Hammer.

3. Dragonfly Doji.

4. Hammer.

5. Morning Star.