Welcome to Tradersideology, where you learn how to invest in the stock market and create wealth.

In this article, we will do a fundamental analysis of Power Grid Corporation, as usual, we will cover the company and the management of Power Grid Corporation, its competitors, its key risk, future growth prospects, and financials based on the analysis we will decide if Power Grid Corporation is fundamentally strong or not then we will do the valuation analysis of Power Grid Corporation to decide if it is worth investing in the company at current levels or not.

Disclaimer: This article is only for educational purposes. I do not recommend buy or sell so please consult your advisor and do your own research before investing.

Introduction

- Power Grid Corporation is the government of India undertaking with a 55.37% equity stake the company has been dividend-paying since 1993 and is the Central Transmission Utility (CTU)of India.

- Power Grid Corporation of India (Power Grid) is an Indian state-owned electric utility company headquartered in Gurugram, India. The company is a ‘Maharatna’ Central Public Sector Enterprise and it is also Central Transmission Utility (CTU) of India.

- The company is one of India’s largest Electric Power Transmission Utility.

- It is Listed Company since 2007. The company undertakes transmission of electricity through Inter-State Transmission System (ISTS). It ensures development of an efficient, co-ordinated and economical system of inter-state transmission lines for smooth flow of electricity from generating stations to the load centers.

- The company also provides non-discriminatory open access to its transmission system for use by and licensee or generating company.

- In 1980, the Rajadhyaksha Committee on Power Sector Reforms submitted its report to the Government of India suggesting that extensive reforms were needed in the Indian power sector.

- In 1981, the Government of India took a policy decision to form a National Power Grid, which would pave the way for the integrated operation of the central and regional transmission systems.

- In October 23, 1989 under the Companies Act, 1956, the National Power Transmission Corporation Limited was formed, and assigned the responsibility of planning, executing, owning, operating and maintaining the high voltage transmission systems in the country.

- In October 1992, the National Power Transmission Corporations name was changed to Power Grid Corporation of India Limited.

- Power Grid operates majorly across three segments namely transmission, consultancy, and telecom.

- The company also has investments in energy efficiency and smart grids.

- As the ratings are based on long-term past performance. They are relevant for at least two years in the future until FY 2022.

Also Read: Praj Industries Stock Fundamental Analysis & Fundamental Analysis of Deepak Nitrite

Fundamental Analysis of Power Grid Corporation

Fundamental Analysis of Power Grid Corporation is differentiated into different categories are as follows, all units are in millions except ratios and per share data.

Economic Model

- The company operates in the utility sector in which market dominance comes through scale distribution network capacity and power generation efficiency in the transmission segment.

- The company has won 63 comma 743 plus CKM (circuit kilo meter) transmission lines and 248-plus substations.

- Further, they also have greater than 99% of system availability and 412 comma 459 plus MBA transformation capacity which is the largest in the industry & in the consultancy segment.

- The company provides transmission-related consultancy to more than 150-plus domestic clients and has a global footprint in 20 countries catering to more than 25-plus international clients in the telecom segment.

- The company owns and operates 60 comma 946 plus km of telecom network and has 688 plus points of presence.

- The power grid also has intra-city network in 105 cities across India and a network availability of 99.5%.

- This overall indicates a wide economic model for the company in terms of capacity,scale, and distribution network therefore this category gets four stars in power grid fundamental analysis.

Business Model and Management

- The business model is such that the company operates in three major verticals namely transmission EHV, HV networks consultancy, and telecom in transmission.

- The company builds high-capacity transmission corridors for IPP projects inter-state inter-regional links and transmission systems for CGS, IPPS, UMPPS, and renewable energy integration in consultancy.

- The company provides in-house expertise in the transmission distribution and telecom sectors including planning, design, engineering, and load dispatch.

- The telecom business leverages power grids nationwide transmission infrastructure and operates as a neutral carrier in the point-to-point bandwidth leasing business.

Management

- Mr. K. Sreekant is the chairman and managing director of the company.

- He has over 33 plus years of experience in the power sector in the areas of long-term financial planning, investment, appraisals, and formulation of capital budgets.

- Mr. Rajeev Kumar Chauhan is the director of projects for the company and has a diverse experience of more than 34 years in EHVAC and DC transmission system.

- Overall the management is qualified and the business model is well diversified for the company but the industry is asset-heavy therefore this category gets four stars in power grid fundamental analysis.

Also Read: Fundamental Analysis of Newgen Software & Fundamental Analysis of Happiest Minds

Company Financials

Company Financials of power grid corporation are as follows:

Growth Ratios

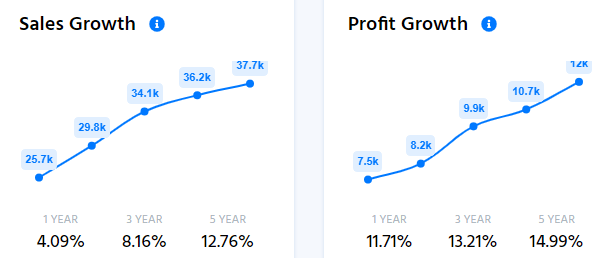

- The revenue has grown at a rate of 19.3% Cagr over the 10-year period the working capital has gone negative which means the current liabilities are more than the current assets.

- This also indicates that the nature of business is asset-heavy the CAPEX has been heavy for the company and has exceeded the revenue over certain years.

- Therefore this category gets three stars in power grid fundamental analysis.

Profitability Ratios

- The gross margin has remained flat over the years and most of the revenue comes from the transmission business.

- The other margins have almost remained flat along with return on assets this indicates stable profitability for the company due to the nature of its business.

- Therefore this category gets four stars in fundamental analysis of the power grid.

Cash Flow Ratios

- The net income margin has been stable over the years and the CAPEX as a percentage of sales has seen a slight decline.

- The free cash flow as a percentage of net income has been negative along with the operating, and free cash flow growth rate this overall indicates a weak cash flow position for the company.

- Therefore this category gets three stars in fundamental analysis of power grid.

Liquidity and Solvency Ratios

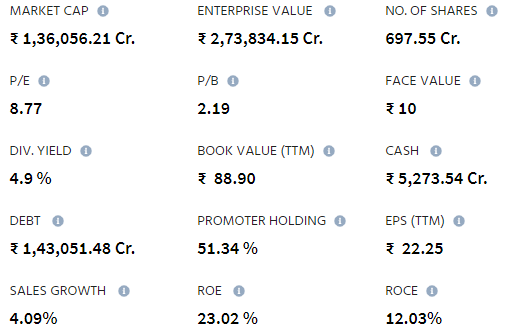

- The company has significant debt in its capital structure and hence the financial leverage and the debt to equity ratios are high.

- The company has stable profitability and the backing of the Indian government hence there is no significant concern to the solvency of the company.

- The current and quick ratios, however, are way below their minimum threshold and indicated moderate illiquidity in the company’s assets therefore this category gets three stars in fundamental analysis of power grid.

Efficiency Ratios

- Overall the business efficiency has deteriorated as the company increased its capacity and entered into new businesses.

- The inventory days have seen a small improvement and the receivables period has remained stable.

- The payable days have declined from 262 days to 120 days.

- The cash conversion cycle is also positive and increasing for the company this is the effect of business expansion in an asset-heavy industry therefore this category gets three stars in power grid fundamental analysis.

ROE and ROCE

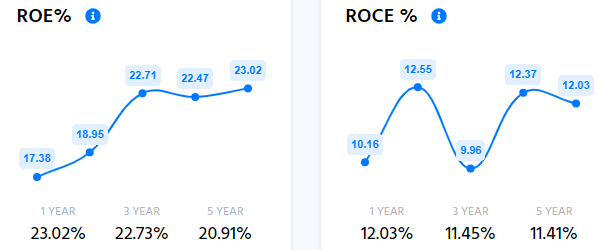

- The leverage ratio has seen a slight increase in recent years along with the asset turnover.

- The interest burden ratio is low due to high debt payments and the tax efficiency has been fluctuating.

- The operating margin has also remained stable over the years.

- Overall the return on equity has been stable even with increased scale and capacity therefore this category gets four stars in power grid fundamental analysis.

- If you look at the shareholding pattern.

- Its promoter has 51.34% stake in the company.

- Foreign institutions hold a 28.28% stake.

- Domestic institutions hold 13.88%.

- General public holds a 6.51% stake.

Future Growth Prospects

- Some insights for the coming years from the analysis management discussions and con calls are as follows:

- The effect of covid 19 would be only of a halt in ongoing projects and some extraordinary expenses.

- The company was planning to incur CAPEX of INR 150 billion and INR 105 billion on a consolidated basis for FY 2020 and FY 2021 respectively.

- The management however can now look forward to conserving cash and defer CAPEX for the future years.

- The company is targeting a capitalization of INR 200-250 which is subject to commissioning of the rhaegar pogolar project this can see increased depreciation cost and hence reduced margins in the future.

- The power grid currently has INR 610 billion worth of work in hand which is expected to get completed in the next three to four years this will be the main revenue driver in the near future.

- The company has noted that there is a likelihood of increasing dividends as CAPEX declines, and on the removal of dividend distribution tax.

- The power grid has a good dividend yield and trading at attractive valuations.

- The fundamentals are moderate and growth is flattened but the company still remains a good long-term investment because of dividend yields.

- Therefore this category gets three stars in power grid fundamental analysis.

Valuation

- The company’s shares have been trading at increasingly lower multiples due to increased competition weak fundamentals and slowing growth prospects.

- The company also has a high dividend yield and hence is not expected to have any significant increase in valuation multiples in the near future.

- Therefore this category gets three stars in power grid fundamental analysis.

Note: The overall rating is arrived at by taking the average of the above 10 category ratings and round it up if it is above 0.5 and rounded down if it is below 0.5 overall fundamental rating power grid shares 3.4 out of 5 therefore it is a three-star stock.

Conclusion

- Overall if we conclude power grid corporation has an excellent business and its management, strong competitive advantage, and good financial and bright growth prospect which makes it a fundamentally good company.

- It is currently available at a fair valuation. What is your take on power grid corporations have you invested in it do let me know in the comment box. I hope you find this analysis useful, and if yes please share it with your friends and family.

- For more trading ideas do follow us on: