Welcome to Tradersideology, where you learn how to invest in the stock market and create wealth.

In this article, we will do a fundamental analysis of Zensar Technologies, as usual, we will cover the company and the management of Zensar Technologies, its competitors, its key risk, future growth prospects, and financials based on the analysis we will decide if Zensar Technologies is fundamentally strong or not then we will do the valuation analysis of Zensar Technologies to decide if it is worth investing in the company at current levels or not.

Disclaimer: This article is only for educational purposes. I do not recommend buy or sell so please consult your advisor and do your own research before investing.

Introduction

- Zensar Technologies is valued at dollar 500 plus million and is in turn a part of a three billion-dollar RPG group.

- The company provides digital transformation cloud and infrastructure data warehousing application development and guidewire support services to global MNCs.

- It is a leading digital solutions and technology services company that specializes in partnering with global organizations across industries on their digital transformation journey.

- A technology partner of choice, backed by a strong track record of innovation; credible investment in digital solutions; and unwavering commitment to client success, Zensar’s comprehensive range of digital and technology services and solutions enables its clients achieve new thresholds of business performance.

- Zensar, with its experience in delivering excellence and superior client satisfaction through myriad technology solutions, is uniquely positioned to help its clients surpass challenges they face running their existing business most efficiently, helping in their legacy transformation, and planning for business expansion and growth through innovative and digital ways.

- The revenue split for the company is 19% from retail, 52% from high-tech manufacturing, 24% from the financial services sector, and 5.1% from emerging enterprises.

- As the ratings are based on long-term past performance. They are relevant for at least three years in the future until FY 2022.

Also Read: Praj Industries Stock Fundamental Analysis & Fundamental Analysis of Deepak Nitrite

Fundamental Analysis of Zensar Technologies

Fundamental Analysis of Zensar Technologies is differentiated into different categories are as follows, all units are in millions except ratios and per share data.

Economic Model

- Zensar Technologies is among five global tech companies listed on any stock exchange for 55 plus years.

- It has shown a solid track record of corporate governance profitability and growth over the last few decades.

- The company has a head start in the field of rapidly growing cloud and infrastructure business, especially in India.

- It competes with several other major tech companies like TCS, Infosys of India, Capgemini of France, and Cognizant of the USA.

- These companies also have established services portfolios so the growth is obtained only by technical know-how Zensar has been able to deliver solid growth of about 28% YoY in digital revenue 16.6% YoY in financial sector revenue and 32% YoY in cloud business revenue.

- Overall this shows a good hold in the market, therefore, the economic model category gets three stars in Zensar technologies fundamental analysis.

Business Model and Management

- Zensar’s top 20 clients contribute to a total of 93.9% of the revenue, the company is focused on its core business of digital transformation, and cloud infrastructure especially in the foreign markets.

- Zensar has managed to achieve consistent growth in Europe and USA markets.

- The European business revenue has increased by more than 20 YoY and the u.s growth is also around 17% YoY this year.

- It had new order winds of dollar 160 plus million in the first quarter itself and also bagged a multi-million dollar deal for a UK-based conglomerate this shows business excellence.

Management

- Mr. Sundeep Kishore is the CEO and MD of Zensar Technologies and had joined the company in 2016.

- Prior to joining Zensar Technologies, he worked at HCL technologies for 25-plus years where he built multiple million-dollar businesses.

- Mrs. Prameela Kalive is the Chief Operating Officer and has been with Zensar technologies for over 18 years.

- She has led multiple portfolios ranging from software delivery global strategy and marketing to HR.

- The management was successful in making Zensar Technologies an important player on the digital superhighway.

- Therefore business model and management category get four stars in Zensar Technologies fundamental analysis.

Also Read: Fundamental Analysis of Newgen Software & Fundamental Analysis of Happiest Minds

Company Financials

Company Financials of Zensar Technologies are as follows:

Growth Ratios

- The company has seen revenue growth of 15% CAGR in the last 10 years.

- The operating income has also increased at an 11% CAGR.

- The working capital is positive and growing which indicates a surplus of current assets over current liabilities.

- The net income has also grown at approximately 10% CAGR therefore growth ratios category gets five stars in fundamental analysis of Zensar technologies.

Profitability Ratios

- The gross margin has seen a small dip over the years due to the increasing cost of revenue.

- The operating margin has also flattened.

- The return on asset and EBIT margin shows some recovery after a small dip and the net margin has also flattened.

- Overall the margins are stable and since the company operates in the services sector further improvement in margins is difficult.

- Growth is achieved only by an increase in revenue which the company is in double digits, therefore, the profitability ratios category gets four stars in the fundamental analysis of Zensar Technologies.

Cash Flow Ratios

- The free cash flow growth rate has remained positive which shows a solid cash position for the company.

- The net income and CAPEX have remained flat over the years but this is common in the IT services industry.

- The free cash flow and operating cash flow growth have seen a reduction over the years due to increasing expenses.

- Therefore cash flow ratios category gets four stars in the fundamental analysis of Zensar Technologies.

Liquidity and Solvency Ratios

- The company is undergoing restructuring changes therefore the current ratio has taken a dip but it is still way above the minimum requirement of 1.

- The quick ratio has also shown stability over the years.

- The financial leverage has seen a small reduction which shows more assets are being financed by equity and thus improving the solvency of the company.

- The debt to equity ratio has also flattened therefore liquidity and solvency ratios category gets four stars in the fundamental analysis of Zensar Technologies.

Efficiency Ratios

- The company’s inventory consists of only some product development business which forms a very small part of the revenue however the inventory has gone down due to low growth in that business segment.

- The payables period has gone up but the receivables period has increased even further this shows an increase in the customer’s bargaining power.

- This leads to an increased cash conversion cycle which is not good for the company as it will have to arrange for interest-bearing short-term debt for working capital.

- Therefore efficiency ratios category gets three stars in Zensar Technologies fundamental analysis.

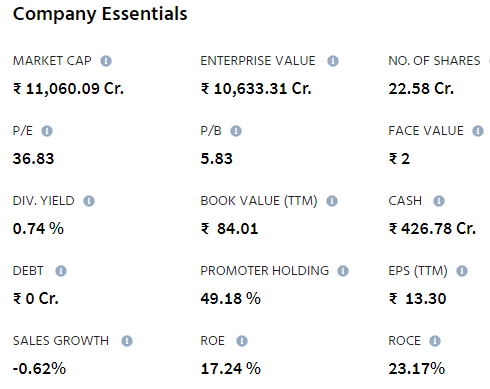

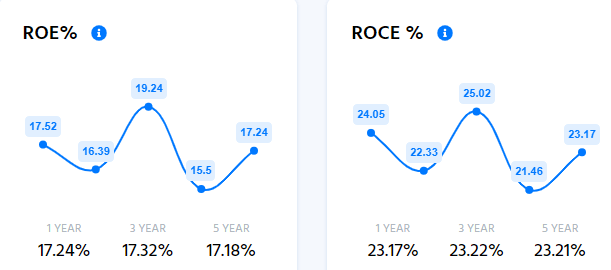

ROE & ROCE

- The company has almost no debt in its capital structure and therefore there is a very low interest burden.

- The operating margin has reduced over the last few years because of the increasing expenses, and inflation.

- Tax efficiency has remained flat and leverage has gone down.

- Overall the company has shown improved solvency but a reduction in return on equity therefore ROE & ROCE category gets three stars in the fundamental analysis of Zensar Technologies.

Future Growth Prospects

- Some insights for the coming years from the analysis management discussions and con calls are as follows:

- sensor technologies remain focused on growth both organic and inorganic.

- The management does not have any plans of increasing the payout ratio despite having a higher cash balance of about 90 million dollars this will be used for acquisitions.

- The company recently announced 170 million dollars of new business orders out of which 45% was from new clients Zensar expects to deliver industry-level growth once the current restructuring exercise is completed in FY 2021.

- There has been a decline in the retail business mostly in the low-margin apparel segment this only formed a small portion of the total revenue so the impact is not very significant.

- The effects of restructuring will be seen in the coming few quarters mostly impacting the margins due to additional expenses these are one-time expenses and the margins are expected to improve at the end of FY 2021.

- Overall the company shows promising growth opportunities and therefore the future prospects category gets four stars in Zensar Technologies fundamental analysis.

- The overall rating is arrived at by taking the average of the above 10 category ratings and round it up if it is above or equal to 0.5 and rounded down if it is below 0.5. overall fundamental rating Zensar Technologies shares 3.9 out of 5 therefore it is a four-star stock.

- If you look at the shareholding pattern.

- Its promoter has 49.18% stake in the company.

- Foreign institutions hold a 17.1% stake.

- Domestic institutions hold 21.13%.

- General public holds a 12.59% stake.

Strengths and Limitations

Strengths and Limitations are as follows:

Strengths

- The Company is Virtually Debt Free.

- PEG ratio is 1.46%.

- The company has effective cash conversion ratio of 274.18.

- The Company has healthy Operating Margin of 27.57%.

Limitations

- The company has delivered poor Income growth of 1.93% over past 3 years.

- Company has high debtor days of 229.48.

Valuation

- The company started trading at high multiples and recently has undergone some correction this makes it an attractive investment as it is currently trading at a lower valuation and has a good growth prospect.

- The impact is generally due to the market slowdown and increased competition but Zensar has consistently shown stable growth therefore valuation ratios category gets five stars in Zensar Technologies fundamental analysis.

Conclusion

Overall if we conclude Zensar Technologies has an excellent business and its management, strong competitive advantage, and good financial and bright growth prospect which makes it a fundamentally good company.

It is currently available at a fair valuation. What is your take on Zensar Technologies have you invested in it do let me know in the comment box. I hope you find this analysis useful, and if yes please share it with your friends and family.

For more trading ideas do follow us on: