In this article, today we will be discussing the Evening Star Candlestick Pattern. I’m presuming that you’ve already read our article about the morning star. If you have not done it, you can always go check it out.

Today we’ll be discussing the Evening Star Candlestick Pattern which is just the opposite of the morning star candlestick pattern. It is a three candlestick pattern and it signifies that there has been a dramatic fall in the prices and now the Sun is about to rise, so prices start making new highs. So let us get started.

What is Evening Star Candlestick Pattern?

The Evening Star Candlestick Pattern is a Bearish and Multiple Candlestick Pattern, consisting of three consecutive incoming candles in the chart, also called Uptrend Reversal Pattern, which means that after the Evening star Candlestick Pattern appears, the bearish pattern can be seen in the stock further, and therefore, based on this pattern, you should find opportunities for Short Selling.

When and how is Evening Star Candlestick Patterns made?

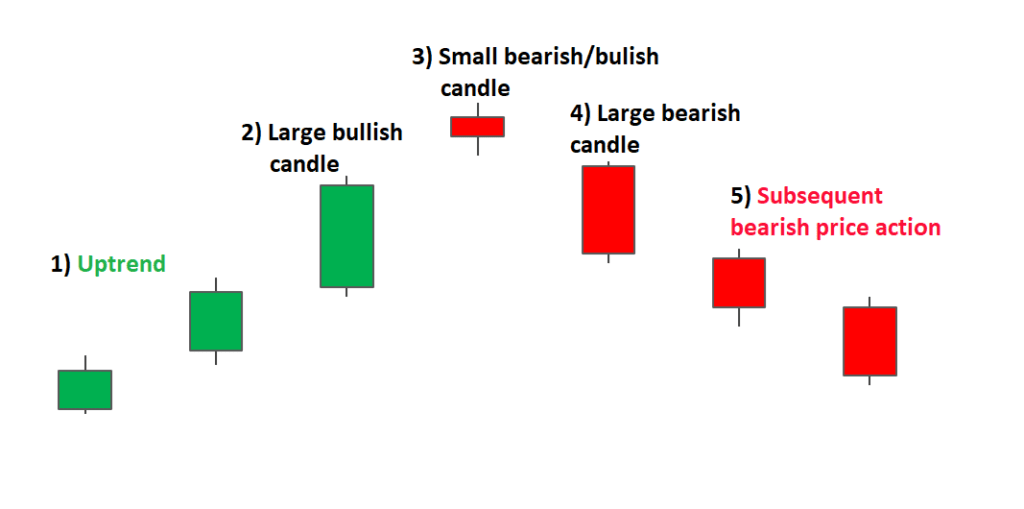

The evening star candlestick patterns, formed at the top of the chart, when the stock is already Bullish i.e . in Uptrend, the stock is at the top of the chart.

When it comes to how The Evening star is formed, there is such a thought process behind the formation of The Evening star pattern.

- The market is in uptrend , and there is complete control of the Bulls,

- The evening star’s first Candle is a Bullish candle that explains the strength of the Bullish market and also sends a message that more and more people want to buy the stock.

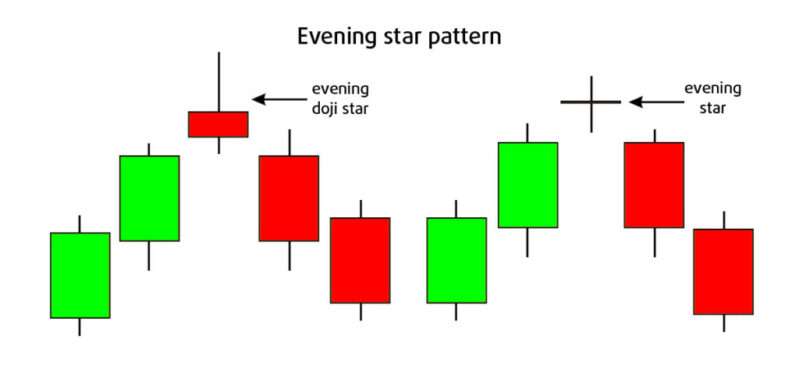

- The evening star’s second Candle begins to form with a gapup opening, and finally the second candle becomes like a Doji or spinning top candle, which tells the state of doubt (Indecision) in the market, and what is going to happen next – nothing past happens.

- The evening star’s third Candle is a Bearish candle with a gapdown opening , which describes the return of Bears to the market, and thus explains that Bulls, who had firmly established their foot hold for the past quite a session, are losing their strength.

- And with the weakening of the Bulls, the Evening star pattern is confirmed and it is expected that the market is going to Bearish further, or there is every possibility ofa return to Bearish trends.

Also Read: How to Trade Morning Star Candlestick Pattern & How to Trade Shooting Star Candlestick Patterns

How to find the Evening Star Candlestick Patterns?

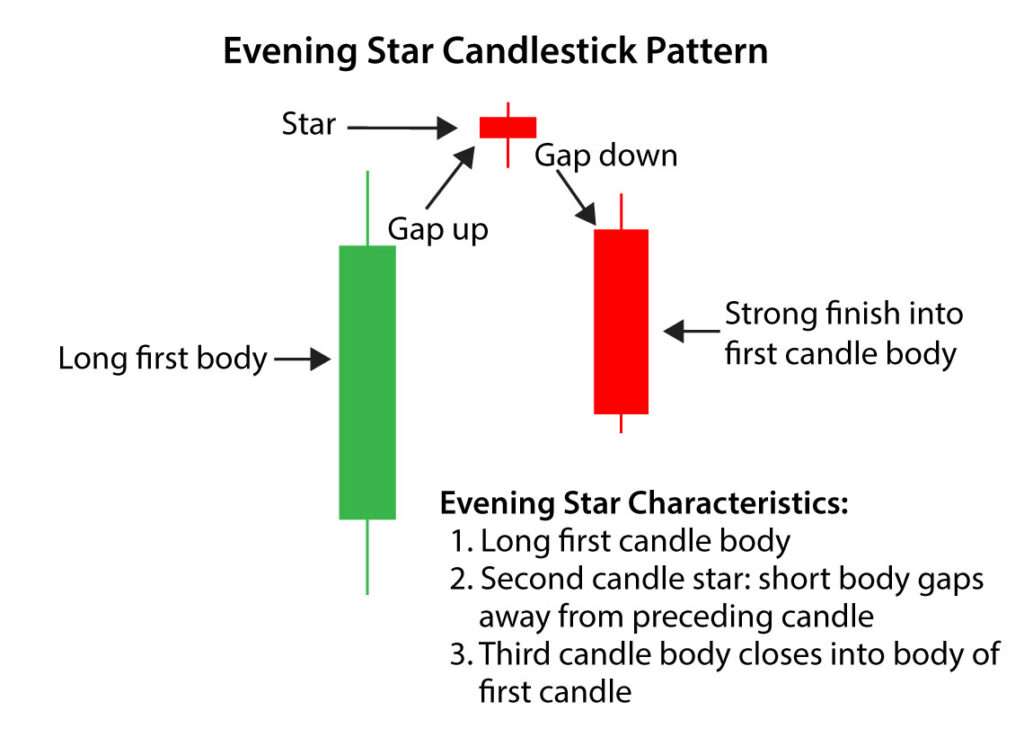

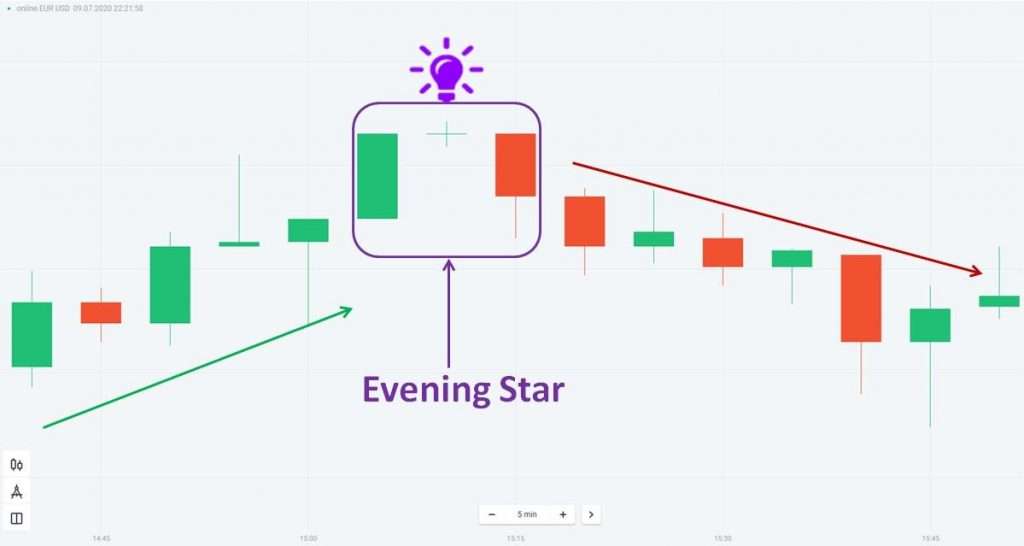

You can see this pattern forming in the figure below:

- Where the first candle is Green that is, Bullish candle.

- The second candle opens with the gapup, and should be like the doji or spinning star candle, and the other one is like the star candle.

- The third candle is a Red and Bearish candle that opens with the gapdown.

You can understand by looking at this pattern in the picture which is circled.

Formation of the Evening Star Candlestick Patterns

- So let us see the conditions. The first criteria are that there has to be a major uptrend or a minor uptrend.

- The body of the first candle needs to be Green in color which shows us in the uptrend is in force and the second candle is a doji which shows indecision in the market.

- The third day should be the opposite in color of the first day. So as we discussed, the first day was Green in color, thus the third day needs to be Red in color which is showing us that the Bears are now back in control.

- As we discussed, in a prior uptrend,

- The first candle should be green in color. Good volume on this day.

- The second needs to be a doji, the color is not important,

- and the third should be red in color which is opposite to the first candle and it should close it should be a large candle and should ideally close into the first candle.

Effect of Evening Star Pattern

The evening star pattern has a bearish effect in the market, as well as the possibility of changing the direction of the market i.e. from Uptrend to Downtrend.

How to Trade Evening Star Candlestick Patterns?

The Evening Star Candlestick Pattern is a Bearish candle pattern, so, we should look for our Short Selling opportunity based on this pattern, that is, to sell the stock first at a higher price and then to make a profit by buying it at a lower price.

Now the question is when did you sell? That is, how do we have a trade set up based on this pattern?

So let’s see –

TRADE SET UP – Based on the Evening Star Candlestick Patterns

- if you Risky trader -you can trade immediately with the evening star pattern being confirmed, and if you are not a Risky Trader you can trade with double confirmation when the next candle is Bearish after the next candle becomes the evening star pattern , and then you can trade with double confirmation.

- This is how the setup of trade can be,

- Sell Price = around the CLOSING PRICE of 3rd of the pattern i.e. Bearish candle

- STOP LOSS = highest Price of the Evening star pattern.

- TARGET = You can set the target according to your RISK MANAGEMENT.

NOTES: There can be three things if you take any trade.

- The market may be BEARISH according to your thinking – you must see your PROFIT BOOK right time.

- The market may be BULLISH contrary to your thinking –andif your STOP LOSS is hitting, EXIT TRADE.

- If market SIDEWAYS, you can wait, and keep an eye on your trade.

If you don’t, you’re not following TECHNICAL ANALYSIS, you’re doing something else, and then everything will be GAMBLING i.e. on luck.

Examples of Evening Star Candlestick Pattern

- Let us get into the practical applicability and see if you understood the pattern.

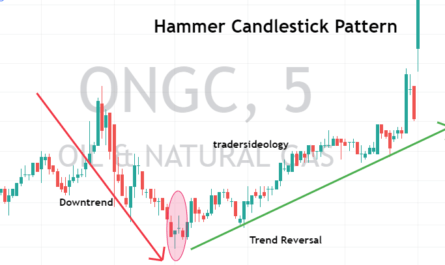

- We can see there has been a uptrend. This is a good uptrend as shown in the above chart.

- Prices start making new highs and at the end of the uptrend we see a very large green candle, so the first condition is a uptrend, it is satisfied.

- The second condition is there has to be a doji or a star needs to be formed and it should gap up which is being satisfied,and the open-close price is almost the same as you can see and there are very large shadows which show us that there is a lot of indecision on this day.

- The third condition is the red candlestick and a very large candlestick.

- The third day is a red candle and it is closing into the red candlestick which shows us that the reversal is imminent and all these candles are gapping.

- This candle is gapping up and the third candle is gapping down, so they are not overlapping.

- So all the conditions are satisfied and we have seen that the volume has also started rising, showing us that a reversal is imminent.

- We can easily enter the trade over here and if you have seen our previous module of the morning star, we can enter the trade at the morning star and we could have exited our trade at the evening star, which shows us that the first is a red candle.

- The second is a doji and the third is a big green candle and prices start to make new lows.

- So you can use these candles in conjunction to get a very good result of when to buy when to sell it, or when to hold.

Conclusion

- Evening Star Candlestick Patterns for day trading or swing trading are usually the best trading patterns to take the trade.

- This setup is very easy and simple to use just you need to keep patience and let your setup form and then you can enter your trades.

- Stoploss should be low or high of the previous swing for uptrend and downtrend and the target would be as per your risk-reward ratio.

- One should follow the Risk Management, Money Management, and Fear and Greed concept of the market to avoid big losses.

- Make sure you see all our articles on candlestick patterns, so you can use them all in conjunction because you will be seeing or witnessing a lot of candlestick patterns, happening in the daily or the weekly charts or the hourly charts.

- If you have good knowledge of these patterns, you can take a very informed trade and you can maximize your returns.

- If you like this article kindly leave a comment in the comment section so that we can know what your thought about this Evening Star Candlestick Patterns.

- I hope you understand the Evening Star candlestick Patterns of technical analysis very well.

- For more trading ideas do follow us on